Everyone’s talking about Microsoft’s AI breakthroughs—but beneath the hype, the company is quietly raking in massive growth from its non-AI businesses. From cloud services to classic productivity tools, Microsoft’s “old-school” tech is booming. And that may be its smartest play yet.

Key Takeaways:

- More than half of Azure’s recent growth came from non-AI services

- Microsoft 365 and productivity tools are seeing double-digit gains

- Non-AI services are proving more profitable than AI offerings

- Microsoft’s diversified growth is giving it a stronger financial base

- Despite high valuations, Microsoft’s core business momentum is undeniable

In a market obsessed with artificial intelligence, Microsoft is pulling off something quietly brilliant: crushing it in areas that have nothing to do with AI.

Yes, Microsoft’s AI-powered Copilot and its integration of large language models into Office tools make headlines. But behind those flashy features is a story of solid, old-school tech fundamentals—and they’re booming.

The company’s latest earnings report shows that while AI is certainly driving attention and innovation, it’s the less-glamorous parts of Microsoft’s empire that are bringing in steady cash—and in some cases, doing even better than the AI segments.

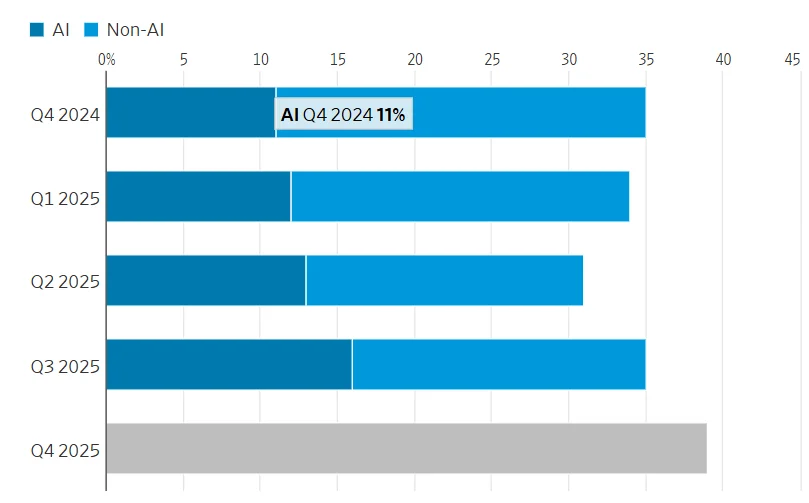

Take Azure, Microsoft’s cloud business. Most would assume its 39% year-over-year growth came from AI-related demand. But more than half of Azure’s 33% revenue jump in Q1—and the majority of Q2’s gains—came from its core infrastructure services. That means companies are flocking to Microsoft not just for AI, but for everyday IT needs: servers, storage, networking, and computing power.

And then there’s Microsoft 365. While some businesses are experimenting with Copilot AI in Word or Excel, many are simply sticking to the basics—because those basics are evolving, too. Commercial cloud revenue for Microsoft 365 grew 16% year-over-year, a notable acceleration. Meanwhile, consumer subscriptions saw a 20% growth—their strongest in years.

This isn’t just a win for Microsoft; it’s a win for investor confidence. In an era where tech valuations are inflated based on future AI potential, Microsoft is proving it can grow today—with or without machine learning.

In fact, non-AI services are more profitable. According to Bernstein Research, Azure’s non-AI infrastructure boasts 73% gross margins, compared to just 30–40% for AI products, which require costly GPUs and data infrastructure. In plain terms: Microsoft makes a lot more money from its traditional services.

There’s a deeper synergy, too. Microsoft’s AI tools are often embedded within its existing products. So even if a user doesn’t pay for AI directly, they might subscribe to Office or Azure because it’s there—and that boosts traditional revenue streams.

Surveys also suggest that businesses are shaking off economic uncertainty and resuming IT spending. A UBS survey from July showed a rebound in confidence, with more companies moving aggressively toward cloud migration. That’s music to Microsoft’s ears.

Meanwhile, Amazon Web Services (AWS) and Google Cloud are still growing but lack Microsoft’s complete enterprise suite. AWS reported 17.5% growth in the latest quarter—well behind Azure’s momentum.

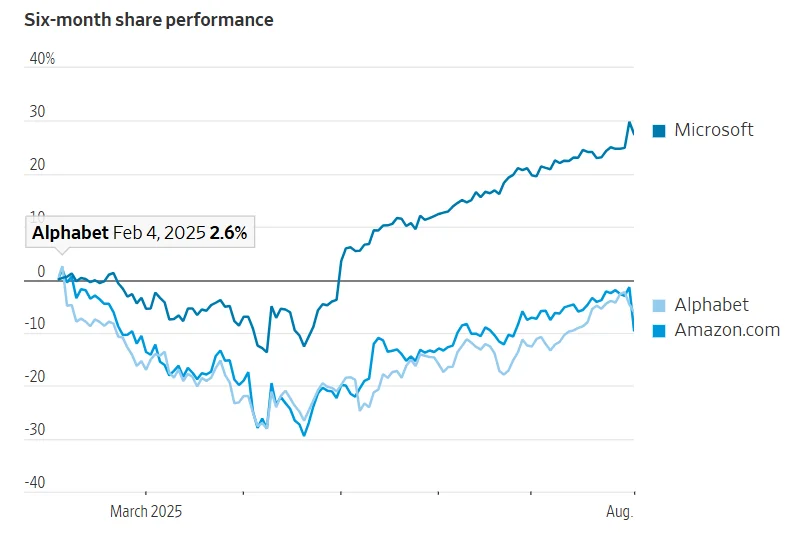

Sure, there are concerns about Microsoft’s valuation. The stock has surged nearly 40% since April, and it now trades at a forward P/E ratio of over 33—more than Amazon, and nearly double Alphabet’s (Google’s parent). But that valuation starts to make sense when you realize Microsoft isn’t just betting on the future of AI. It’s winning now, across multiple fronts.

As CEO Satya Nadella emphasized, record user growth in AI is feeding Microsoft’s broader ecosystem—and even if Copilot doesn’t become a runaway hit, users are sticking around for everything else.

In short, Microsoft is showing the market what sustainable tech growth looks like. Not just in the AI arms race—but in the fundamentals that built Big Tech in the first place.