New York–based Keychain has raised $30 million in Series B funding to accelerate the development of its AI-powered manufacturing platform, KeychainOS. The system promises to cut waste, predict bottlenecks, and transform how consumer packaged goods (CPG) are made worldwide.

Key Takeaways

- Keychain raises $30M to expand AI platform for CPG manufacturing.

- Backed by General Mills, Hershey, Wellington Management, BoxGroup.

- KeychainOS aims to cut waste, predict bottlenecks, boost efficiency.

- Company supports 20K+ brands, 25K manufacturers, millions in revenue.

- AI captured 71% of US venture capital funding in Q1 2025.

Keychain, a New York AI startup, raised $30 million in Series B funding to scale its AI-driven platform for CPG manufacturing. The company’s KeychainOS system helps brands and manufacturers reduce waste, forecast supply chain issues, and improve real-time planning. Backers include Wellington Management, BoxGroup, General Mills, and Hershey.

Keychain’s Big Bet on AI

The AI investment boom shows no signs of slowing. This week, New York–based startup Keychain announced a $30 million Series B round, positioning itself as a new contender in the consumer packaged goods (CPG) manufacturing space.

The funding was led by Wellington Management and BoxGroup, with continued backing from major CPG players including General Mills and Hershey.

“It’s time for us to increase our investment, particularly in engineering, product design and analytics,” said Oisin Hanrahan, Keychain’s CEO and co-founder, in a statement.

What Keychain Does

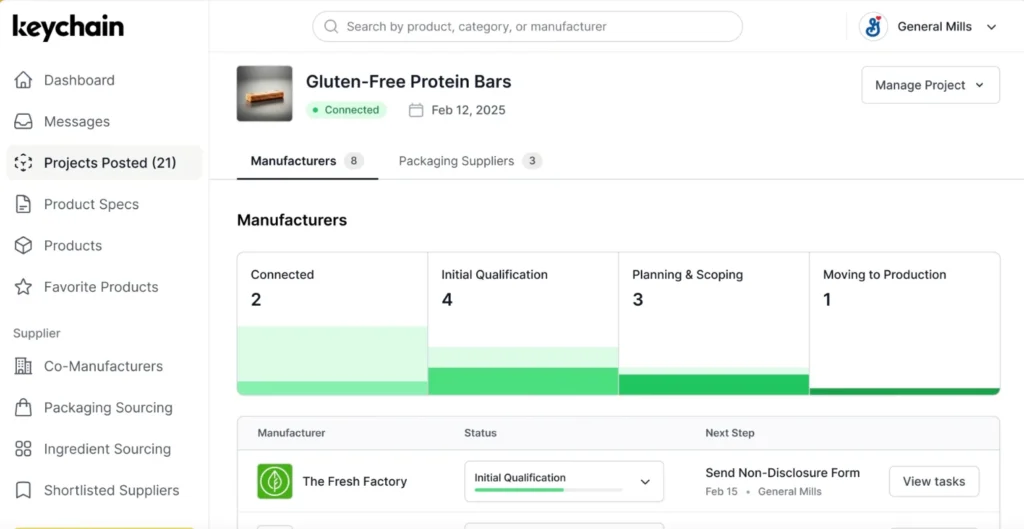

Keychain operates an online marketplace where brands can connect with more than 25,000 manufacturers. The company already supports 20,000+ brands and retailers, from Whole Foods to 7-Eleven.

Its new product, KeychainOS, aims to function as a next-generation ERP (enterprise resource planning) system. Using AI, the platform helps manufacturers reduce waste, predict bottlenecks, and optimize real-time production schedules.

Tom Hermes, VP of sourcing and product development at Whole Foods, praised the system:

“The tool allows our teams to better identify prospective manufacturers who can meet the requirements of our product roadmap.”

A Growing Trend in AI Investment

Keychain’s fundraising fits a larger pattern: AI accounted for 71% of U.S. venture capital funding in Q1 2025, according to PitchBook.

But the excitement comes with caution. Sam Altman, OpenAI’s CEO, recently warned that AI investment may be in a “bubble”, even as he stressed the technology’s long-term value.

Hanrahan acknowledges that reality but says Keychain wouldn’t exist without AI:

“It would not have been possible to build any of this company, at this level of investment, without huge amounts of AI.”

Why It Matters

If Keychain succeeds, AI could fundamentally change how everyday products are manufactured—from snacks to supplements to beauty goods. Faster, smarter supply chains could mean fewer shortages, reduced environmental waste, and more affordable goods on shelves.

Reader Impact

For everyday consumers, this could translate into shorter supply chain delays, more consistent product availability, and potentially lower prices. For small and midsize brands, AI-driven manufacturing tools could finally level the playing field against global giants.

Numbers to Watch

- $30M — Keychain’s new Series B funding.

- 71% — Share of U.S. VC invested in AI in Q1 2025.

- 25,000+ — Manufacturers already on Keychain’s platform.

What’s Next

- Expansion of KeychainOS beyond food and beverage into supplements, beauty, and household goods.

- Growing competition as AI-backed supply chain startups attract more funding.

- Potential headwinds from trade tariffs and shifting U.S.–China supply policies.

Conclusion

Keychain’s $30 million raise underscores two trends: investors’ hunger for AI, and the urgency of modernizing global supply chains. If the company delivers on its AI-driven promises, CPG manufacturing could become faster, leaner, and more sustainable.

The real question: will AI-powered platforms like KeychainOS define the future of how products are made—or will the hype outpace the impact?