In the race to build autonomous systems that can transact and operate independently, identity is emerging as a structural bottleneck. Not human identity, but machine level identity that is persistent, verifiable, and economically native.

That is where MoltID enters the conversation.

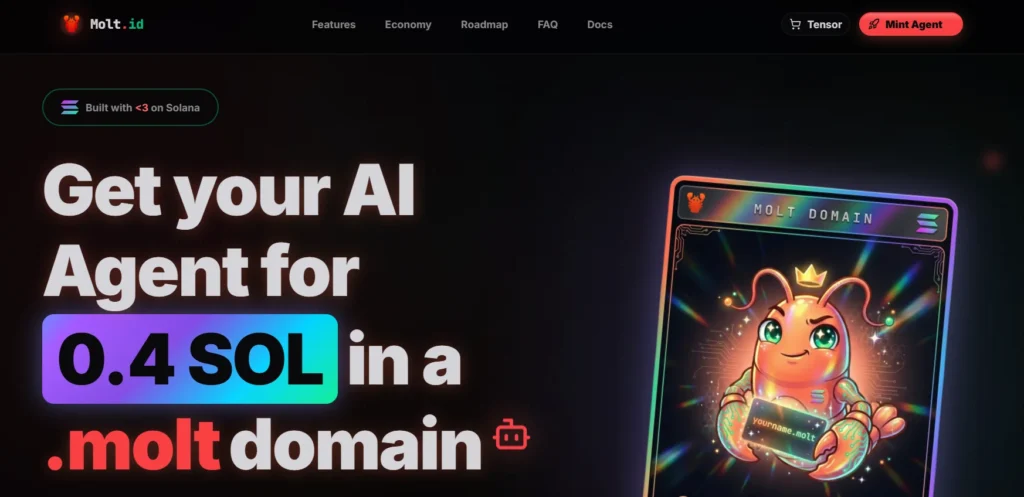

Backed by the SolRocket incubator, MoltID is positioning itself as a foundational identity layer for AI agents operating on Solana. The project introduces blockchain based domains designed to anchor agents with sovereign identifiers, embedded wallets, and payment functionality.

The ambition is infrastructure. The question is adoption.

Identity as Infrastructure

AI agents are moving beyond chat interfaces. Developers are experimenting with systems that hold wallets, execute transactions, and participate in decentralized markets.

For that model to function, agents need durable identity primitives. MoltID issues .molt domains wrapped as Metaplex Core NFTs, creating permanent on chain identifiers tied to wallet functionality.

More than 340 domains have reportedly been minted ahead of the presale window.

Each domain is described as supporting a keyless AI wallet where the owner co signs activity while maintaining structural immutability. If implemented securely, that could reduce private key exposure risk, a long standing pain point in crypto native automation.

The technical details of that wallet architecture will ultimately determine whether this becomes credible infrastructure or remains experimental.

Whitelist Structure and Capital Strategy

Instead of a conventional presale model, participation requires minting one .molt domain for each 1 SOL of intended allocation. The allocation range sits between 1 and 5 SOL per wallet.

The presale carries a 1,000 SOL hard cap and a 500 SOL soft cap. The projected initial market capitalization is approximately 350,000 dollars, with 70,000 allocated to initial liquidity.

This structure does two things.

It filters for participants willing to commit capital early, and it distributes identity assets among initial backers rather than concentrating allocation in a small number of wallets.

From a capital efficiency standpoint, the raise is modest relative to many recent crypto launches. That could reduce immediate token pressure but also limits near term runway unless supplemented by additional funding or sustained revenue.

Ecosystem Positioning on Solana

Solana has become a testbed for AI and crypto convergence. Its transaction speed and NFT infrastructure make it technically suitable for identity linked experiments.

If MoltID integrates cleanly into developer workflows, it could function as middleware. In that scenario, agents built by third party teams would rely on .molt domains for identity anchoring and transaction execution.

If developer adoption remains limited to incubator affiliated projects, the impact will likely stay narrow.

Infrastructure gains relevance only when external builders choose to integrate it.

Adoption Friction and Technical Questions

Several variables remain unresolved.

The wallet co signing model requires clearer documentation. Enterprise or serious developer adoption depends on transparent security architecture and audit disclosures.

On chain hosting claims raise scalability questions. Fully on chain logic can be expensive. Hybrid architectures introduce coordination complexity.

The broader AI agent economy is still early. Many production systems today remain centralized. A decentralized identity layer assumes future demand that has not yet fully materialized.

That timing creates both opportunity and risk.

Business Viability

Long term sustainability will depend on recurring utility rather than one time domain mint revenue. If agents transact frequently through these identities, transaction fees or service layers could create durable economics.

If usage slows after the presale phase, revenue concentration could become a constraint.

Liquidity allocation at launch may provide short term market stability, but organic activity determines long term resilience.

What Comes Next

The presale mechanics are clear. The stronger signal will emerge after launch activity settles.

The key metrics to watch include developer integrations beyond the incubator circle, active agent deployments tied to .molt domains, and transparency around wallet security design.

If those indicators show growth, MoltID could establish itself as early infrastructure in the AI Agent economy on Solana.

If they do not, it risks becoming another niche identity experiment in an ecosystem still searching for durable agent scale.

For now, the strategy is evident. Build identity rails before the agent economy accelerates. Whether that timing proves early or precisely aligned will depend on how quickly real world usage follows the mint count.